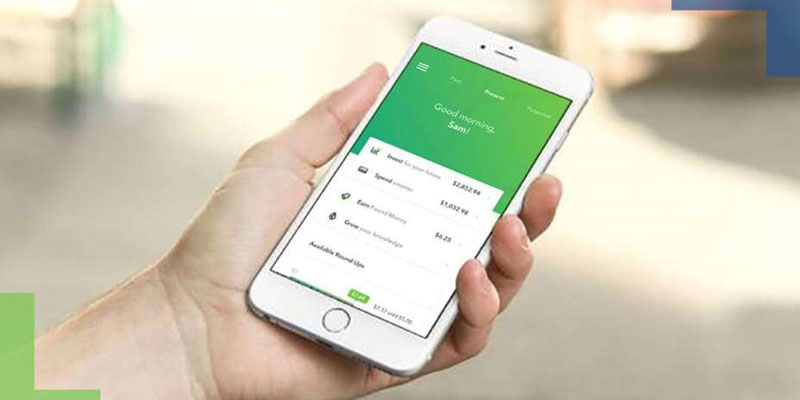

The firm made its debut on the iOS store operated by Apple (and then on Android a few months later), where it immediately attracted customers' attention. Over the first ten weeks of the beta test, Acorns attracted more than 10,000 members, each of whom deposited around $3 daily in roundups.

Around the same time, the firm changed its leadership, and Noah Kerner was elevated to the CEO position. Even at a young age, Kerner was enthusiastic about business and entrepreneurship. At the age of 13, he started to show a significant interest in DJing, and by the time he was 25, he was working as a DJ at a Super Bowl after-party, on The Tonight Show with Jay Leno, and even on tour with Jennifer Lopez.

How Do Acorns Generate Revenue for Its Users?

Acorns generate revenue via membership fees, fees for transferring money between accounts, referral fees, administration fees, and interest received on cash balances. Let's go into more depth about each of the three sources of income listed below. In the following paragraphs, we'll examine each topic in further detail.

Subscription Plans

Acorns organize its goods into various subscription levels, each of which the company makes available monthly. The names of its levels are Lite, Personal, and Family, respectively. Acorns Invest is accessible to subscribers of the platform via the Lite tier, which costs one dollar per month. Users of Invest can have their remaining change automatically rounded up and invested in exchange-traded funds (ETFs). Users can earn additional investments whenever they execute a transaction with one of Found Money's more than 350 partners. Companies such as Sephora, Warby Parker, and Dollar Shave Club are examples of those in this category.

Invest, Later, and Spend are all part of the Personal package, which costs an additional $3 each month and contains all three items. Later is a retirement account that allows its members to gain tax benefits. Members of Spend can set up a checking account. Benefits associated with this account include the absence of account and ATM fees, the possibility of receiving a bonus investment of up to ten percent, and the provision of an investment account. Family, which costs $5 a month, covers all of the goods that have been covered up to this point in addition to Early. With Early, parents can open investment accounts for their children, establish automated contributions on a recurrent basis, get family financial guidance, and save money on taxes.

Referral Fees

When one of Acorns' more than 350 Found members of the Acorns community uses Money partners to make a purchase, the company receives a referral fee. The referral fee handed out is subject to the unique agreements indicated in the partnership contract. However, in most cases, the referral fee consists of a modest percentage charge of the total purchase volume. The user then receives a proportional percentage of the income generated by their referrals, which Acorns either deposits into their account directly or invests on their behalf.

Interchange Fees

Users can submit an app for a checking account that comes standard with a debit card issued by Visa and is free of charge. The account is FDIC-insured up to a maximum of $250,000, and in addition, it provides free withdrawals from ATMs, built-in smart deposits, and other features.

When you use your debit card at a store, the store incurs interchange fees, which Acorns profits from. The merchant pays these costs. The interchange charge is often somewhere around one percent of the whole transaction. Nevertheless, it is probable that Acorns and Visa, the card issuer, are sharing the earnings between them.

Management Fees

Accounts with a balance of more than $5,000 are subject to a one-quarter of one percent yearly management fee from Acorns. This accounts for the time and effort required to choose the most advantageous investment possibilities for each user. The maintenance fee will not be charged to any members with a balance in their account that is less than $5,000. They will, however, pay one of the subscription fees detailed earlier in this paragraph.

The Interest Accrued On Cash

Much like any other traditional bank, Acorns takes its customers' money in their accounts and lends it to other organizations, such as other financial institutions. After that, they get interest payments from these institutions (also called Net Interest Margin). According to Statista, the net interest margin for all banks operating in the United States in 2019 was equivalent to 3.35 percent.